Guide

Basics

Dec 12, 2025

Excise Tax in the United Arab Emirates: understanding the surcharge on harmful products

What is Excise Tax in the United Arab Emirates?

Excise Tax is a fiscal surcharge applied to products considered harmful or detrimental.

It was introduced for two main reasons:

to reduce the consumption of harmful products,

to offset their health and environmental impact.

It is a tax separate from VAT or customs duties and is added on top of other tax obligations when goods are imported or sold.

Which products are subject to Excise Tax?

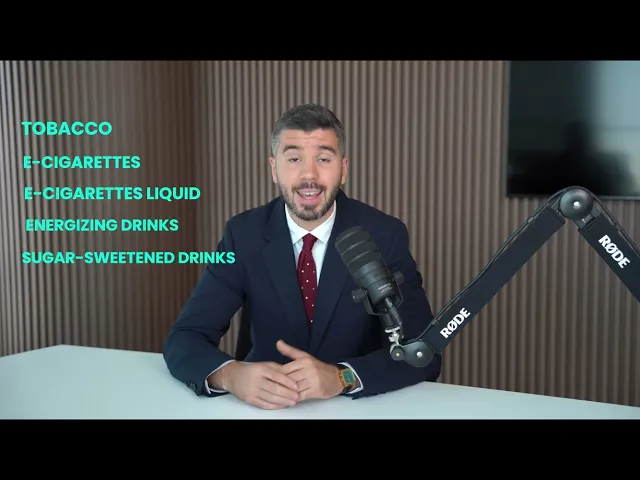

In the United Arab Emirates, Excise Tax applies in particular to:

tobacco and all related products,

electronic cigarettes,

e-liquids for electronic cigarettes,

energy drinks,

sugary or heavily sweetened beverages.

These categories may evolve depending on decisions by the Federal Tax Authority (FTA), but the principle remains the same: any product that has a negative impact on health or the environment may be subject to this surcharge.

What is the applicable surcharge rate?

The Excise Tax rate generally ranges between 50% and 100%, depending on the type of product.

This taxation can therefore double the cost of a product even before VAT or commercial margins are applied.

The objective is not purely fiscal: Excise Tax also aims to limit consumption, encourage more responsible behavior, and reduce the importation of harmful products.

It is important to note that this surcharge is not a customs duty. It is an internal UAE tax, calculated independently of any applicable customs fees.

Why is this tax important for businesses?

Any business that imports, manufactures, or sells products subject to Excise Tax must:

register with the Federal Tax Authority,

register with the Federal Tax Authority,

declare the relevant quantities,

pay the surcharge before the products are released onto the market.

Failure to comply with these obligations can lead to significant penalties, and above all, customs or logistical blockages.

This tax must therefore be factored in upfront when designing the business model, pricing structure, and margin forecasts.

Conclusion

Excise Tax is an important component of the UAE tax system. It applies to high-risk products and can reach up to 100% of their value. For distribution, import, or e-commerce businesses, it is essential to understand this surcharge, verify whether the products they sell fall within its scope, and properly factor its impact into their pricing strategy.

A solid understanding of this regulation helps avoid costly mistakes and ensures full compliance when importing or selling goods.

table of contents

Ready to take the next step?

© 2025 Daftime